@infoinsightwave

Business

infoinsightwave.comOctober 7, 20243 Mins read90 Views

infoinsightwave.comOctober 7, 20243 Mins read90 Views

Ola Electric’s Share Price: Reasons Behind the Decline!

Recent Posts

Related Articles

Business

How Reducing Food Waste Can Skyrocket Economic Growth and Save the Planet!

Food waste is a pervasive issue that impacts societies across the globe,...

Byinfoinsightwave.comNovember 25, 2024

Business

Elon Musk Made Dogecoin Explode—Here’s How

When it comes to cryptocurrencies, few names generate as much buzz as...

Byinfoinsightwave.comNovember 23, 2024

Business

What is trading business?

Trading has been one of the oldest forms of commerce; most of...

Byinfoinsightwave.comOctober 14, 2024

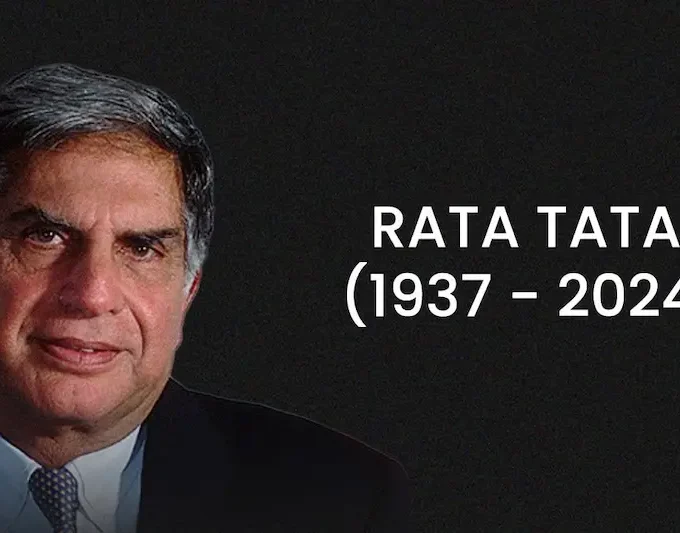

BusinessNews

Tribute to Mr. Ratan Tata: A Visionary Leader Who Changed India and the Whole World

It’s the end of an era for Ratan Tata, one of India’s...

Byinfoinsightwave.comOctober 10, 2024

Leave a comment